Monzo’s £21m Fine: Your Supplier Verification Wake-Up Call

Sarah Drakard · Head Of Operations, Canopy

6 min read · 15 Jul, 2025

Photo by Rui Chamberlain on Unsplash

When Monzo Bank was fined £21 million for accepting fake customer addresses like “10 Downing Street” and “Buckingham Palace” the headlines focused on banking failures.

But the real takeaway? A wake-up call for every organization that relies on accurate third-party data. Especially procurement teams.

The Monzo Misstep: A Cautionary Tale

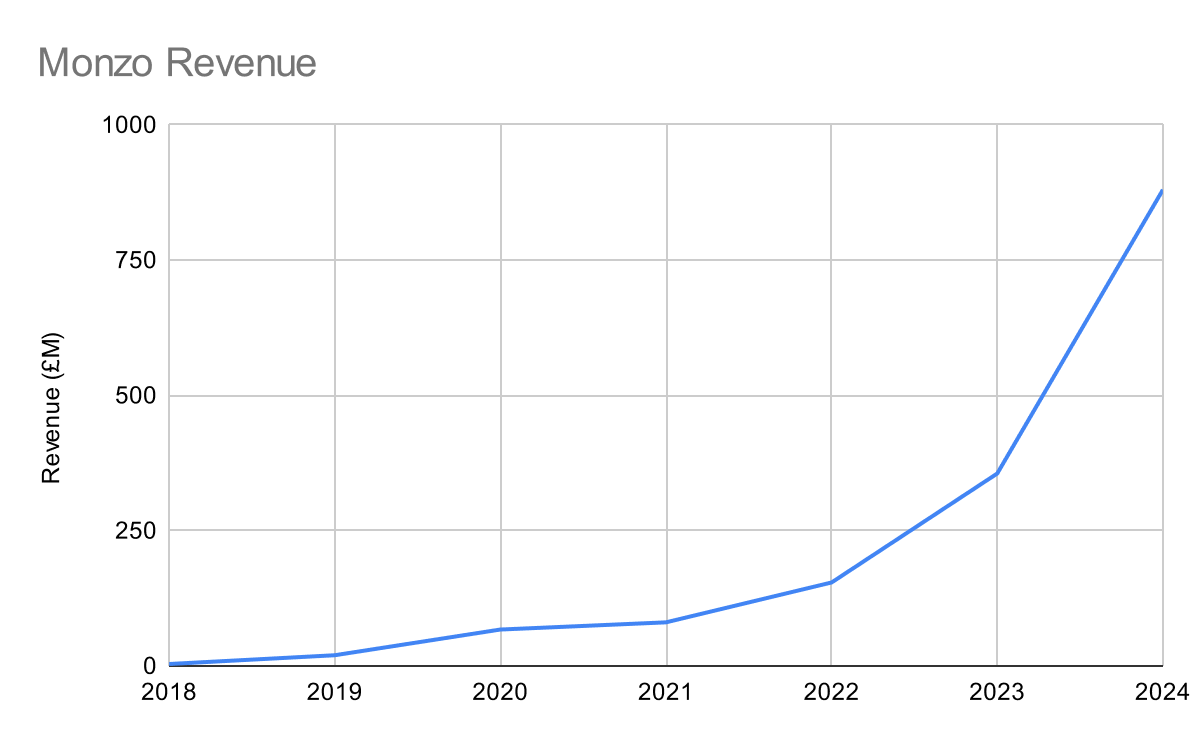

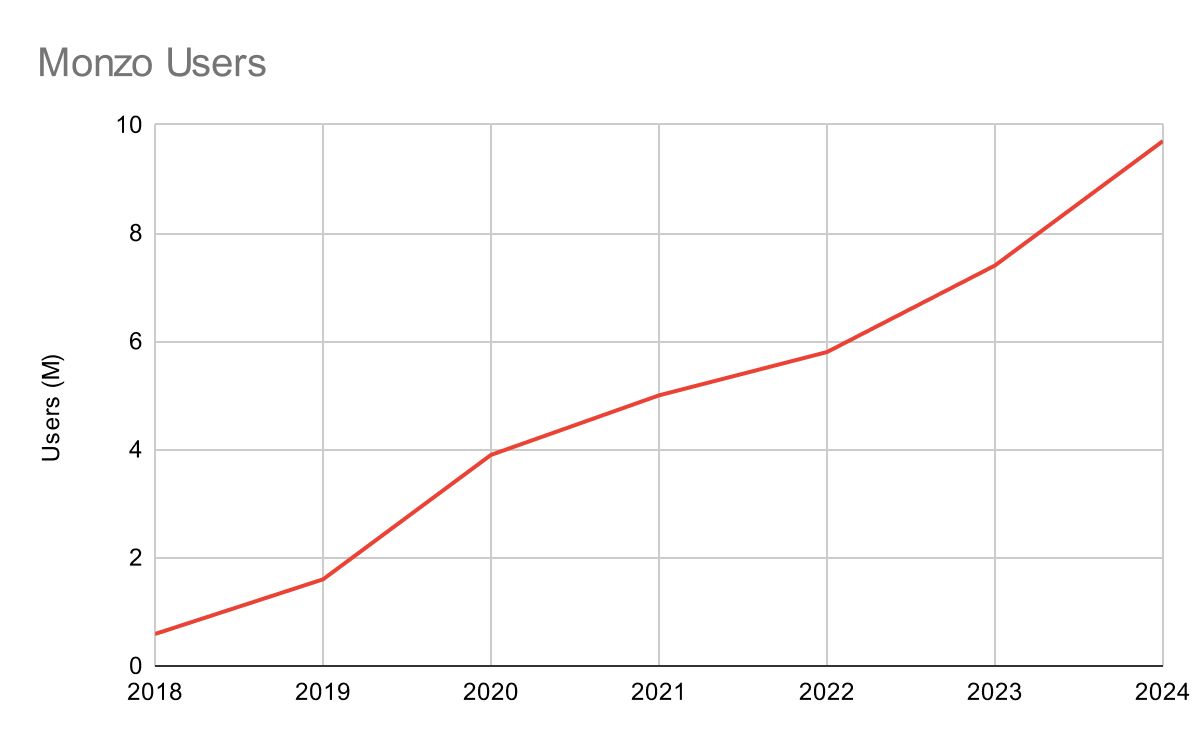

The Financial Conduct Authority’s investigation revealed that Monzo’s rapid growth came at a cost. Between 2018 and 2022, the digital bank’s customer base exploded from 600,000 to over 5.8 million users. But their verification systems couldn’t keep pace, leading to a spectacular failure in basic due diligence.

The bank accepted applications from customers claiming to live at some of London’s most famous addresses, used PO boxes without proper verification, and even allowed people to register using Monzo’s own business premises as their home address. The FCA described these oversights as evidence of “how lacking Monzo’s financial crime controls were.”

But here’s the crucial connection: while Monzo’s verification failures led to regulatory fines, supplier verification failures can be equally devastating. When suppliers aren’t properly vetted, organizations face similar risks: financial losses, reputational damage, and operational disruption. The core issue is identical: inadequate verification processes that can’t handle scale.

Consider these uncomfortable questions:

- When did you last verify your suppliers’ addresses? A UK manufacturer recently discovered their “key supplier” was actually operating from a residential address after the company had vanished overnight, leaving them scrambling to find alternatives for a critical production deadline.

- Are you accepting documentation at face value? Just as Monzo failed to flag obviously implausible addresses, many procurement teams don’t have systems to automatically validate basic supplier information against reliable databases.

- Is your supplier onboarding process keeping pace with your business growth? The FCA noted that Monzo’s controls “failed to keep pace with its customer and product growth.” Sound familiar?

Data from Business of Apps. Graphs by Canopy.

The Hidden Costs of Poor Supplier Verification

The financial penalty for Monzo was £21 million, but the real costs of inadequate supplier verification extend far beyond regulatory fines:

Operational Disruption: When suppliers turn out to be unreliable or non-existent, projects stall. Deliveries fail. Internal teams scramble to find alternatives at premium costs.

Financial Losses: Poor supplier verification creates multiple avenues for financial loss. Duplicate payments. Fraudulent invoicing. Fake suppliers. These aren’t edge cases. They’re happening every day.

Reputational Damage: Your organization’s reputation is only as strong as your weakest supplier link. One fraudulent or failed supplier can undo years of brand building.

Audit Failures: During compliance audits, incomplete or inaccurate supplier records trigger investigations, additional scrutiny, and potential sanctions.

The Real Lesson: You Can’t Scale Manual Processes

The challenge facing procurement teams mirrors what happened at Monzo, but there’s a deeper lesson here. Monzo’s real mistake wasn’t growing too fast, it was trying to scale manual verification processes that were never designed for volume.

Having worked with hundreds of procurement teams, from startups to enterprises, we’ve seen this pattern repeatedly: organizations attempt to handle exponential growth using the same manual systems they started with. Excel spreadsheets, email chains, and paper-based approvals that worked for 50 suppliers become catastrophic risks when applied to 500 or 5,000.

The procurement parallel is striking. Many teams are trying to verify suppliers using:

- Email requests for certificates and compliance documents

- Excel spreadsheets to track verification status

- Manual reviews of supplier information

- Paper-based approval workflows

These approaches don’t just slow down as you scale, they break down entirely. And when they break down, that’s when “10 Downing Street” starts looking like a reasonable supplier address to an overwhelmed procurement professional rushing through their verification backlog.

Learning from Monzo’s Mistakes: A Better Way Forward

The good news is that Monzo’s experience offers valuable lessons for strengthening your supplier verification process. The key insight? Automation isn’t just about efficiency, it’s about maintaining quality standards at scale.

1. Implement Automated Verification Just as banks now use automated systems to flag suspicious addresses, your supplier onboarding should include automated checks against company registries, address databases, and sanctions lists. What takes a human 20 minutes to verify manually can be checked automatically in seconds. And with greater accuracy.

2. Replace Manual Tracking with Automated Workflows Stop managing supplier approvals through email chains and spreadsheets. Automated workflows ensure every supplier follows the same verification steps. Nothing falls through the cracks. You have complete audit trails.

3. Automatic Document Expiry Management Don’t rely on manual calendar reminders for certificate renewals. Automated systems track expiry dates across thousands of suppliers and send alerts before documents expire.

4. Risk-Based Automation Not all suppliers require the same level of verification. Automated systems can adjust verification requirements based on spend levels, risk categories, and industry type. Something impossible to manage manually at scale.

Photo by Onur Binay on Unsplash

The Bottom Line

Monzo’s £21 million fine serves as an expensive reminder that you cannot scale manual verification processes without creating significant risks. The bank’s rapid growth from 600,000 to 5.8 million customers should have been a success story, but their reliance on manual controls turned it into a compliance nightmare.

For procurement professionals, the message is clear: Your supplier verification process isn’t just administrative overhead, it’s a critical business control that must be built for scale from day one. The same manual processes that work for 50 suppliers will fail catastrophically at 500, creating the exact same risks that cost Monzo £21 million.

The question isn’t whether you can afford to invest in automated supplier verification systems. After seeing what happened to Monzo, the real question is: Can you afford to keep scaling manual processes that are destined to fail?

Canopy helps procurement teams automate supplier verification with automatic data validation, document expiry tracking, and built-in risk-based workflows. You’ll never miss a red flag.

Start your supplier database audit today and build a verification process that’s truly built for scale.

References

- BBC News: Monzo gave account to fake 10 Downing St address

- Financial Conduct Authority: Final Notice – Monzo Bank Limited

- The Guardian: Monzo fined £21m for failing to prevent money laundering

- Business of Apps: Monzo Revenue and Usage Statistics (2025)

Supplier Management Insights

Keep up to date with key Canopy features and industry news in our blog